The Next Chapter of Luxury Living.

What I’m Seeing in Westchester County, NY & Fairfield County, CT in 2026

As someone who has worked in real estate, mortgages, and senior living for nearly 20 years, I’ve seen luxury homes evolve dramatically, but 2026 marks a meaningful shift. Luxury is no longer just about size, price, or show-stopping features. Today’s buyers in Westchester County, NY and Lower Fairfield County, CT are looking for intention, comfort, and homes that truly support how they want to live both now and in the years ahead.

More than ever, high-end buyers want homes that feel personal, purposeful, and adaptable. Especially as many are planning for their future, aging in place, or transitioning into a new chapter of life.

What Luxury Buyers in Our Area Want Most in 2026

In our communities along the Sound Shore and beyond, privacy and security remain top priorities. Gated properties, quiet cul-de-sacs, wooded settings, and generous lot sizes are especially appealing to buyers who want a sense of retreat while still being close to everything Westchester and Fairfield offer.

Indoor and outdoor living has become essential rather than optional. I’m seeing tremendous demand for homes with retractable glass walls, expansive patios, outdoor kitchens, fire pits, and resort-style pools, features that allow families to truly live outside from spring through fall.

For many of my clients, particularly downsizers and active retirees, flexibility inside the home is critical. Buyers want dedicated offices, quiet workspaces, and adaptable rooms that can serve as guest suites, caregiver spaces, or accommodations for multigenerational living. This is especially important for families thinking ahead about aging parents or long-term care planning.

Wellness-focused amenities are also becoming mainstream in luxury homes here. Private gyms, yoga or meditation rooms, saunas, steam showers, cold plunges, and spa-inspired bathrooms are transforming homes into personal wellness retreats, something I see resonating strongly with health-conscious buyers in our area.

Smart-home technology is now expected in high-end homes. Systems that control lighting, climate, security, and entertainment are no longer a “perk” they’re a standard feature that buyers assume will already be in place.

And of course, kitchens remain the heart of the home. I’m seeing continued demand for professional-grade appliances, catering kitchens, wine rooms, butler’s pantries, and elevated entertaining spaces perfect for the way so many families in Westchester and Fairfield love to gather.

Lifestyle First:

Especially for Seniors and Downsizers

Many of the clients I work with are looking beyond the house itself and focusing on lifestyle. They want proximity to parks, walking trails, beaches, and charming downtowns like Rye, Greenwich, Scarsdale, and Larchmont.

For seniors and near-retirees, walkability, access to healthcare, and community amenities are becoming just as important as the home’s square footage. Buyers are choosing locations that make it easier to stay active, connected, and engaged. Whether that means being near a village center, a golf club, or the waterfront.

Innovative Features Gaining Popularity

While the categories of luxury amenities aren’t entirely new, they’re evolving in exciting ways:

-

Flexible rooms with movable walls and smart built-ins

-

AI-driven home systems that learn daily routines

-

Advanced wellness spaces like infrared therapy rooms and recovery suites

-

Immersive entertainment options including golf simulators, high-end listening rooms, and speakeasy-style bars

-

Discreet safe rooms or security-enhanced spaces that balance comfort and protection

What This Means for Buyers and Sellers in 2026

In Westchester and Fairfield, ultra-wealthy buyers continue to purchase based on lifestyle rather than market conditions. Meanwhile, many other luxury buyers are being more thoughtful investing in timeless, high-quality elements while keeping décor flexible so their homes can evolve over time.

For sellers, this means that staging, presentation, and showcasing lifestyle features is more important than ever.

How I Help My Clients Stay Ahead

As a Senior Real Estate Specialist, my role goes beyond just listing and selling homes. I help families think through their long-term needs, whether that means downsizing, rightsizing, relocating, or planning for aging in place.

I also collaborate closely with designers, stagers, attorneys, financial advisors, and senior care professionals to ensure my clients have the right team around them every step of the way.

If you’re thinking about selling, buying, or planning your next move. I’d love to be a resource for you.

📞 Feel free to reach out anytime to discuss your home, your goals, or the local market.

📚 Article Reference:

“The Next Era of Luxury Living: What Buyers Want in 2026.”

The Institute for Luxury Home Marketing, January 9, 2026.

If You’re Considering Downsizing, You’re Not Alone

Whether you’re exploring options for yourself or helping a loved one prepare for a transition, having the right expert by your side makes all the difference.

If you’re searching for downsizing help, senior relocation guidance, or a compassionate professional who understands the emotional and practical steps of selling and moving, I’m here to support you from start to finish.

Together, we can design a downsizing plan that feels thoughtful, intentional, and full of possibility.

Let’s start the conversation about your next chapter.

As your local SRES® (Seniors Real Estate Specialist), I’m here to guide you every step of the way.

Whether it’s planning, selling your home, or finding your next perfect space, I’m ready to help.

Let’s simplify your move together!

Jennifer Martire Baukol for all your real estate needs.

“I am committed to providing the most personable, elite and professional customer service.

My promise to you is to

(1) put your interests first,

(2) help you reach your goals quickly,

(3) treat you as she would like to be treated,

(4) focus on the solution not problems, and

(5) provide you with the highest level of attention and feedback.

Whether you need extra room for a home office or nursery, or a smaller home that requires less upkeep and cost, I’ll bring you to the place that’s tailor-made just for you.

Servicing Westchester County, New York & Fairfield County, Connecticut.

Contact me today to get started. (914) 584-2211.”

White Plains Local Real Estate. Scarsdale Real Estate. New Rochelle Real Estate. Rye Real Estate. Rye Brook Real Estate. Larchmont Real Estate. Harrison Real Estate. Purchase Real Estate. Edgemont Real Estate. Tarrytown Real Estate. Armonk Real Estate. Greenwich Real Estate. Old Greenwich Real Estate. Stamford Real Estate. Darien Real Estate. Local Realtor. Get Organized. Selling Home. Westchester County, New York. Fairfield County, Connecticut. Selling your home. Downsizing.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

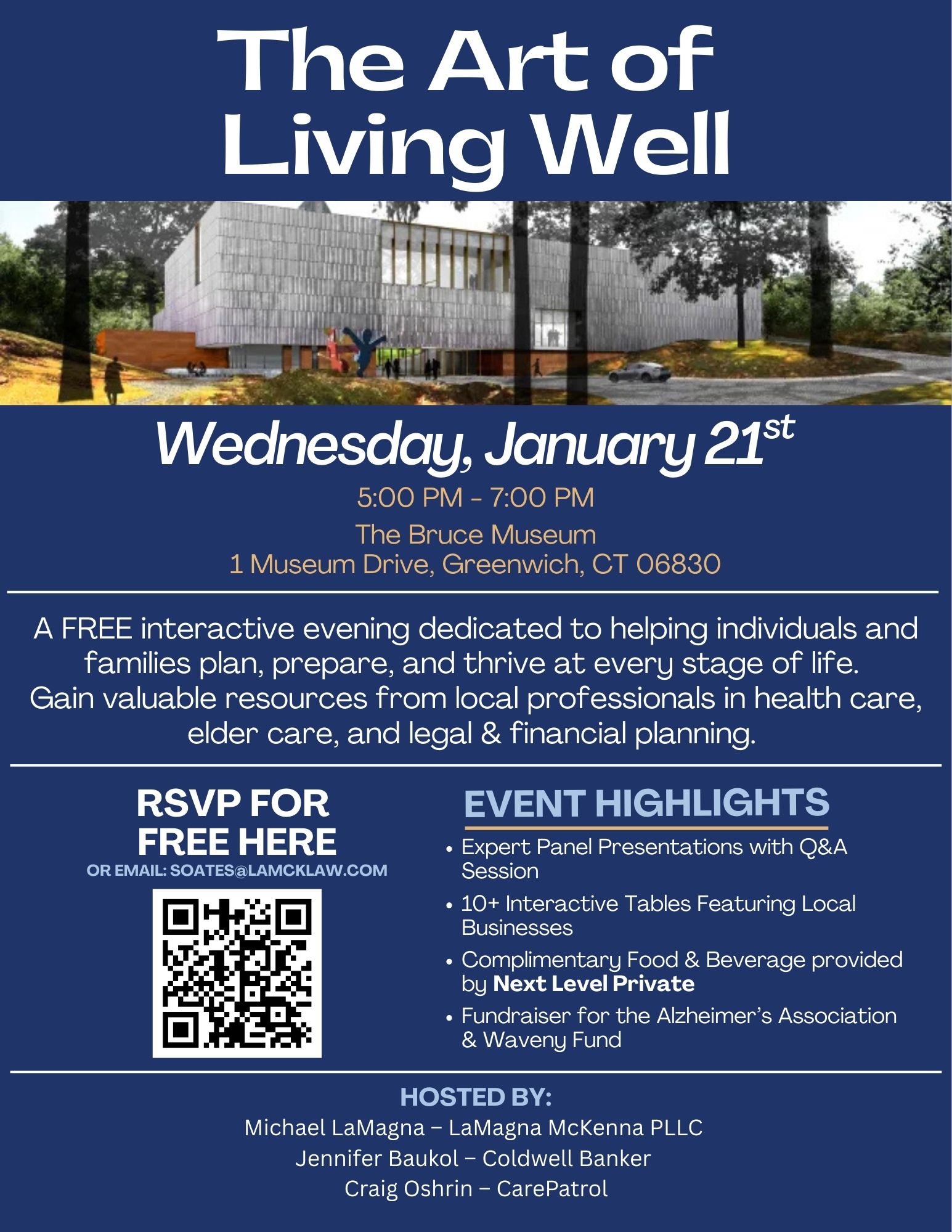

Tonight’s Art of Living Well event was truly a success.

My hope was that everyone who attended felt welcomed, had fun, and most importantly left with meaningful, trustworthy information they can actually use.

A huge thank you to Next Level Private for the incredible food and drinks. They are caring, passionate, and professional, an amazing firm with an equally amazing team. Gary J. Raniolo II, Steve Bohmert, John Kenney Jr., Tom Elliott, just to name a few.

Our panel was exceptional.

Starting with Stephanie Rice from the Bruce Museum who shared insight into their Lifetime of Looking program.

Chris Punsalan highlighted the value of Tendercare, helping families understand what’s real, who can be trusted, and how to navigate care with confidence. Hayden Housson did a great job interacting with the attendees at their resources table.

Terry Henry, MBA, CNC, CRM from Waveny LifeCare Network thoughtfully explained their communities and the benefits they offer loved ones living with dementia.

Christopher Curran and Craig Oshrin from CarePatrol were not only my co-hosts but did a wonderful job walking families through their process and how they help people navigate the complex world of aging in person so they can live safely.

We also heard outstanding, practical guidance from LaMagna McKenna PLLC. Michael LaMagna from the firm and Barry Mitchell, Jr. from Next Level Private were fantastic on stage together. Their expertise, advice, and insight gave the audience truly actionable steps to take home and think about.

And thank you to our moderator for keeping the conversation engaging, informative, and lively. lol 🤣 (that was me)

I’m incredibly grateful to everyone who participated and attended. Our resource tables were a prefect way for attendees to ask all the questions they had. Thank you Andi Hughes, Phyliss Juliano RN MSC, Glenn Frisbie, Marla Alt – CPO, Alicia Kacinski, Esther McCarthy, Shauna Sweeney, Mimi Santry, Joan Brustman, Jacqueline O’Leary Cummaro, @Debbie Feldman Caring Transitions, Rick Gang, Joseph Lawliss (thank you for doubling as my town caller), Eliso Papaladze,MSW, CDP, Sheila Kolt, LCSW, CMC, Dana Reisch, LMSW, CMC, Lon Epstein, Jennifer Beato, Sarah Gorenstein, @Nancy Marshall, Mario Mirabella, Daniel McKenna.

I truly hope this is the first of many “Art of Living Well” events to come.

PS ***SAVE THE DATE*** June 18th 2026. Battle of the Chefs returns. 🧑🍳 🔥